Corporate Governance Glossary

- Homepage

- Corporate Governance Glossary

Corporate Governance Glossary

Corporate governance is essential as companies stay private longer and the Venture Capital/Private Equity industry faces increased demands from limited partners.

Why? Good governance improves performance, creating sustainable profitability for shareholders and high ethical standards towards other stakeholders.

To help you understand and implement best practice, our glossary explains the essential terms relating to corporate governance in private companies.

A

Accounting Fraud

The intentional manipulation of accounting records or entries to inflate financial performance, hide failures, or mislead investors.

Accounting Quality (Quality of Earnings)

The degree to which accounting figures accurately measure a company’s profitability, assets, liabilities and cash flow. Deviation due to error or accounting fraud may result in a company being wrongly valued.

Accounting Restatement

Discloses and corrects previously issued financial statements. The nature and severity of the financial impact may affect the company’s valuation and lead to legal claims by investors.

Activist Investor

An Investor who actively pursues governance changes in a company, typically a shareholder seeking a change in strategy, management, or management remuneration.

Administration

When a company becomes insolvent and is put under the management of a licensed practitioner. The administrator may be appointed by directors, secured lenders or shareholders through a court order to protect the company and its position. Successful administration leads to continued trading (perhaps with restructuring) and a failed administration leads to bankruptcy.

Agency Cost

An internal company expense that comes from an agent taking action on the principal’s behalf.

Agency Problem

A conflict of interest between two parties. In companies, agency problems occur when managers act in their own self-interest instead of the interest of the company and its shareholders. Companies can protect against agency problems through good corporate governance practices.

Aligned Incentives

When the goals of senior executives sync with shareholder interests.

Anglo-Saxon Model

A term describing the shareholder-centric corporate governance models practiced in the US, UK, and other English-speaking countries. The model seeks to maximize shareholder value, encourage management participation, emphasize transparency and enforce contracts and standards.

Annual General Meeting (AGM)

The yearly meeting of a company’s shareholders. At an AGM, directors present and approve financial statements, confirm appointments, and make decisions that require shareholder representation.

Articles of Association

One of the two governing documents that form a company’s constitution. The Articles define the type of business, shareholder rights, director responsibilities, and how the organization will make decisions. See also Memorandum of Association.

Assurance

The outcome and process of providing stakeholders with a degree of confidence or comfort, including independent assessments.

Audit Committee

The committee responsible for overseeing a company’s external audit including the disclosure process, accounting policies and principles, compliance, internal controls, and the performance of the auditor. Using a committee structure creates independence and reduces the potential for the manipulation of the audit by management.

back to top ↑

B

Bankruptcy

A legal proceeding in which a company becomes insolvent, typically when its liabilities exceed the value of its assets. The process allows the entity to become free from its debts while triggering legal obligations related to the treatment of creditors, shareholders, and debt providers.

Best Practices

Practices, policies, and procedures that have been shown to lead to better financial and non-financial outcomes. Best measured across a large number of companies over a reasonable timeframe.

Blockholder

A shareholder with a relatively large ownership position in a company’s common stock and/or bonds. Blockholders can often influence company governance with the voting rights awarded with their position.

Board Handbook

A guide for board members with information on how the board functions.

Board of Directors

A group of individuals elected to represent the interests of shareholders and monitor the company and its management. The board serves in an advisory role and an oversight role. In its advisory role, the board consults with management on company strategy and the direction of operations. In its oversight role, the board monitors management and makes sure they are acting in the best interest of the company and its shareholders. This includes hiring and firing personnel, measuring performance, and awarding compensation.

Board Diversity

The degree to which individual directors on a board represent a broad range of personal or professional backgrounds, attributes, experiences, and perspectives.

Board Evaluation

The process by which a board, its individual directors, and committees are evaluated. This process should occur regularly to measure a board’s performance and its ability to meet new demands.

Board Pack

A collection of documents and reports that serves as an outline for board meetings. The pack provides key information relevant to financial standing, the progress of plans, and other important updates. The board pack helps directors prepare, enabling them to save time and draw more value from each meeting.

Board Structure

The description of a board based on structural attributes such as size, demographic breakdown, independence from management, number of committees, and director compensation.

Board Succession Plan

A plan that allows for a smooth transition of board members when they resign, rotate out after term, or are replaced. A good succession plan ensures the continuity of board performance and helps maintain relationships with management and committees. The plan should include selection criteria, rules, procedures, and potential candidates.

Business Judgment Rule

A rule in which courts will not scrutinize a board’s decision if the board can demonstrate that it followed a reasonable process by which it informed itself of relevant facts and arrived at the decision in good faith, even if the decision led to a negative outcome.

Business Model

A conceptual model that maps a company’s strategy into key components. Supports better alignment between strategy and daily execution. A company’s board will evaluate the business model for commercial logic, consistency, , and its chances of success.

Busy Board

A board with several busy directors.

Busy Director

A director who sits on at least three boards.

Bylaw

A self-imposed rule made by a company to regulate itself.

back to top ↑

C

Chairman of the Board

The public face of the board and its most powerful member. The chairman presides over the full board of directors and is responsible for scheduling meetings, agenda-setting, and coordinating committee actions. Historically, the CEO has served as chairman in the United States but it’s becoming more common for non-executive directors to serve as chair.

Check-Box Mentality

Simply satisfying an arbitrary list of criteria without deeply considering whether these criteria add value or meet criteria.

Chief Executive Officer (CEO)

The CEO oversees a company’s operations and reports to its board of directors. The CEO is a company’s highest-ranking officer and serves as a key point of communication between the board, management, and other stakeholders.

Chief Financial Officer (CFO)

The CFO is responsible for managing a company’s finances.

Chief Governance Officer (CGO)

The CGO is accountable to the Board for the design, structure, implementation, and performance of its governance principles.

Civil Law

A system of law with decisions based on a strict interpretation of comprehensive legal codes rather than legal precedent. Sometimes referred to as “code law.”

Code of Best Practices

Guidelines or recommendations on corporate governance issued by independent experts that set the standard for the governance structures, strategies, and actions to help companies achieve good governance. Notable codes of best practice:

- The Cadbury Committee (1992)

- The Greenbury Report (1995)

- The Hampel Report (1998)

- The Higgs Report (2003)

Code of Conduct

A document that establishes an organization’s standards of behavior and the procedures in place when these expectations are not met.

Co-Determination

A system prevalent in German corporate law in which employees have the right to vote representatives onto a company’s board of directors. This system is designed to align incentives and reduce friction between employees and executives.

Common Law

A system of law based on legal precedents established by the courts in previous rulings. Past judgments on similar matters influence the interpretation and application of laws rather than relying on strict readings of written law. Also known as case law.

Company Secretary

A person appointed by the directors of a company who is responsible for making sure that the company complies with company law. This person is not necessarily the same person who carries out the secretarial duties (for example takes the minutes). The company secretary role may be outsourced to an accounting or law firm.

Comply or Explain

An approach to corporate governance in which organizations use a principle-based code rather than a rigid ruleset. Boards are expected to follow the recommended practices (comply) or explain the validity of any divergence.

Conflict of Interest

When private interests compete with professional responsibilities. For instance, when a board is deciding whether to award a contract to a company owned by one of its members. While this is typically legal, the board member with competing interests must not influence the decision.

Conflict of Loyalty

When a board member’s decisions are, or might be, influenced by objectives other than the organization’s best interests. For example, when a board member feels responsible for representing the group that nominated them.

Constitution

In the US, this document establishes a company’s identity, purpose, and rules for governance. The Companies Act requires that all new businesses submit their constitution to the local registrar. See Memorandum of Association (external affairs) and Articles of Association (internal affairs) for European model.

Compensation Benchmarking

The process of comparing a company’s senior executive compensation to that of other companies, often in the same industry. Compensation committees use this tool to help determine executive pay.

Compensation Committee

The committee of a board responsible for determining CEO goals and compensation, and advising the CEO on other executive and non-executive goals and compensation.

Compensation Discussion and Analysis (CD&A)

The CD&A provides investors with the material information required to understand the organization’s executive compensation programs. Companies under the jurisdiction of the SEC must disclose this information but the SEC does not regulate the amount or type of compensation.

Compliance

How an organization ensures that its activities conform and comply with all relevant laws, regulations and contractual obligations. Often run by a specific compliance team and overseen by an independent reviewing body.

Compliance Risk

The degree to which a company complies with all relevant laws and regulations. A company’s compliance is determined by factors such as labor practices, environmental compliance, products, and processes.

Consolidated Financial Statements

Statements combining the assets, liabilities, equity, income, expenses, and cash flows of a parent company and its subsidiaries, including disclosures and accounting policies.

Consolidated Management Statements

Providing performance indicators and unaudited financial statements of companies. Management statements enable frequent data analysis before the closing of financial periods and efficient responses to problems or obligations.

Control Mechanism (Internal Controls)

Policies, processes and controls that a company puts in place to ensure desired outcomes. Independent performance checks support the effectiveness of these internal controls.

Corporate Actions

An activity that may bring a material change to an organization and impact its shareholders. Corporate actions may be mandatory or voluntary, influencing how the board of directors should initiate and shareholders react (vote).

Corporate Governance

The framework of systems, processes, rules, disclosures and relations used to control and operate a company. Corporate governance aims to balance the interests of all key stakeholders. Good governance is a commitment to ensure that decisions support the long-term sustainability of a company in measurable ways.

Corporate Governance Rating

Numeric scores or letter grades that represent the quality of a company’s corporate governance according to a rating system which combines quantitative and qualitative factors to arrive at a single value.

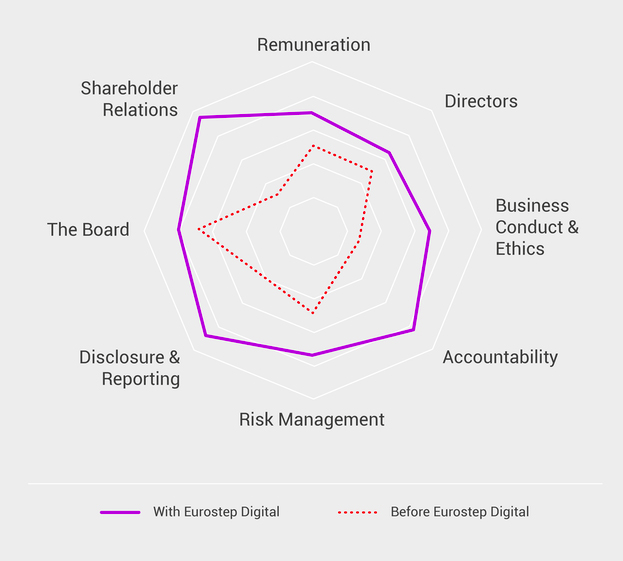

The Eurostep Digital Code of Corporate Governance comprises of thirty five measures based in eight categories:

Corporate Law

Corporate law refers to the laws and regulations that pertain to companies and covers issues such as shareholders’ rights, operations, mergers, acquisitions, and management. Not to be confused with business law which covers general issues such as taxes and employment.

Corporate Monitors

Parties hired to monitor, detect, and prevent malfeasance within a company.

Corporate Performance Management (CPM)

The systems, practices, and processes that a company uses to monitor and manage its performance. CPM is a form of business intelligence (BI) that uses KPIs (key performance indicators) to improve processes, reduce costs, and enhance forecasting.

Corporate Plans

The strategic, business and financial plans that, together, describe the company mission, objectives, resources and what actions are required to make that happen. Corporate governance involves monitoring and evaluating these plans to make sure the company stays on course.

Corporate Social Responsibility (CSR)

CSR is a form of self-regulation which helps companies contribute to societal goals and be socially accountable. Sometimes referred to as corporate citizenship, CSR promotes awareness of a company’s economic, social, and environmental impact and encourages practices that increase benefits and mitigate damage.

Corporate Strategy

A company’s approach to decision-making with the goal of maximizing shareholder value. Corporate strategies incorporate each component of the business to optimize operations, cash flows, human capital, and governance. Performance is measured using key performance indicators.

Cumulative Voting

A voting system that allows shareholders to cast votes across board nominees without restricting the number of times one can vote for a single nominee. This allows shareholders to concentrate votes on a single candidate. Shareholders have votes equal to their number of shares multiplied by the number of seats up for election.

Custodian

A bank or other professional service provider that safeguards financial assets for companies and their investors. Custodians are typically large, reputable firms protecting assets worth billions of dollars. Custodians usually offer related services such as account admin, payment collection, transaction settlement, and tax support.

back to top ↑

D

Delegated Authority

When a governing body authorizes another party to make decisions on their behalf, for example when a board of directors delegates authority to a CEO to make management choices. Delegating authority does not delegate responsibility.

Director

A member of a company’s board of directors, limited by guarantee.

Director Indemnification

When a company reimburses a director for legal fees, costs, settlements, and judgments incurred from claims against the director connected to the director’s good-faith service to the company.

Directors’ and Officers’ (D&O) Liability Insurance

Insurance purchased by a company to protect its directors and officers from litigation brought against them for alleged acts committed while carrying out their duties. Most policies do not cover intentional criminal acts.

Diversity, Equity, and Inclusion (DEI)

A term that refers to policies and procedures that promote not only the participation of people with a wide range of differing characteristics (diversity and inclusion) but fairness and justice in terms of the distribution of resources for those groups that have been historically under-represented (equity).

Dodd–Frank Wall Street Reform and Consumer Protection Act 2010

A response to the 2008 financial crisis that aimed to improve transparency and governance in the US financial system. Reforms included giving shareholders the ability to nominate directors, vote on executive compensation and also expanded disclosure requirements.

Drag-Along Rights

Please visit our Private Markets Glossary.

Dual-Class Shares

When a company has two classes of common stock, with one class having more voting power than the other. This approach is controversial if it helps one group of shareholders maintain control of the company.

Duty of Care

The fiduciary responsibility of directors to act in good faith when making decisions. This moral and legal responsibility requires that directors are sufficiently informed, act without conflict of interest, and demonstrate significant consideration for the consequences of their decisions.

back to top ↑

E

Earnings Management

Earnings management is the manipulation of finances through accounting techniques or timing to create a misleading portrayal of company finances. While not all acts of earnings management are fraudulent, most are a sign of poor corporate governance.

Environmental, Social, Governance (ESG)

The concept of environmental, social, and governance (ESG) incorporates these non-financial considerations into the strategy of private and public companies. The rationale is that ESG creates more sustainable performance and stronger stakeholder relations. Investors increasingly require companies to demonstrate their ESG stewardship and may make this a criteria for providing capital and/or reporting. Companies can start to build their ESG credentials through good corporate governance.

Executive Remuneration (Executive Compensation)

The total value of the financial and non-financial compensation that an executive receives from their employer. This can include base salary, bonuses, company shares, benefits, and performance incentives.

Executive Session

A meeting or portion of a meeting with only independent, non-executive directors present. Since executives are not present, independent directors typically use this time to discuss management performance, succession, and compensation.

Extraordinary General Meeting (EGM)

A meeting of a company’s shareholders other than the annual general meeting. The EGM is typically called on short notice with the purpose of dealing with urgent matters.

back to top ↑

F

Fiduciary Duty

When a person [fiduciary] has a legal obligation to act in the best interest of another party [principal or beneficiary] by exercising discretion and expertise when acting on their behalf. The board of directors’ duty to the company has been interpreted as an obligation to the shareholders and includes duties of care, loyalty, and candor.

Financial Accounting Standards Board (FASB)

The private, non-profit organization that sets the standard for the Generally Accepted Accounting Principles within the United States, and works with the International Accounting Standards Board (IASB) on international accounting standards.

Financial Restatement

A financial restatement occurs when one or more material errors are discovered in a company’s previously published financial statements. The restatement corrects the error and alerts investors that the previously published financials are no longer reliable.

Financial Risk

The possibility of losing money on a business venture or other investment. Financial risk can also refer to the degree to which a company relies on debt to fund operations. Companies that rely heavily on external financing are typically at greater risk than those that can generate their own capital.

back to top ↑

G

Generally Accepted Accounting Principles (GAAP)

The set of generally accepted accounting principles and procedures that dictates how companies should record business transactions in a country. See also International Financial Reporting Standards (IFRS).

Good Faith

To act honestly without the intention to mislead, withhold information, or wilfully ignore responsibilities.

Golden Handcuff (Golden Handshakes)

Financial incentives and deterrents intended to prevent an executive or employee from leaving a company. This includes deferred financial gain such as stock options that require a vesting period and contractual agreements to return bonuses if the employee leaves a company before a specific date.

Governance Code

Policies, processes, standards and disclosures that guide executives and boards. Areas covered can include:

- Board Composition

- Director Responsibilities

- Business Ethics

- Accountability

- Risk Management

- Reporting and Disclosures

- Remuneration

- Shareholder relations

Governance Committee

A committee with a supervisory role towards the board itself, overseeing the quality of governance and making recommendations.

Governance Model

A framework that organizes a company’s principles, values, and goals and outlines its approach to operations, finances, risk management, and reporting to ensure good corporate governance practices.

Governance, Risk, Compliance (GRC)

GRC is a corporate management system that integrates three functions (governance, risk, and compliance) across a company’s operations. GRC seeks to promote cooperation and prevent a ‘silo mentality’ that reduces transparency.

Governing Document

An organization’s founding document that establishes its legal existence, primary purpose, and basic rules. See also Articles of Association and Memorandum of Association.

back to top ↑

H

Hostile Takeover

When a target company receives an unsolicited acquisition by an acquirer. The acquirer might engage in a proxy fight, going directly to the company’s shareholders to replace the management with one that will approve the takeover. They can also make a tender offer at a price above the current market price.

back to top ↑

I

Independent Non-Executive Director (INED)

A member of the board of directors who is not an executive and is not directly involved with the company’s day-to-day operations. Instead, the iNED advises with independent, constructive criticism to make sure that companies are working in the best interest of shareholders.

Insider Trading

When individuals with access to a company’s non-public, material information buy or sell that company’s shares. These trades are typically illegal depending on the timing and are punishable by fines and/or time in prison.

Integrity

Then quality of being honest and having strong moral principles that do not waiver.

Interlocked Boards

When executives from different companies sit on each other’s board of directors.

Internal Audit

A self-examination of a company’s activities, processes, procedures, accounting, and corporate governance. Audits help ensure compliance and identify improvements prior to an external audit.

International Financial Reporting Standards (IFRS)

The set of principles and procedures that informs companies on how they should record and report financial statements. The wide adoption of the IFRS makes accounting efforts more consistent across borders. The IFRS is an example of principles-based accounting.

Investor Relations (IR)

The management of communication between a company and its shareholders and debt investors. IR aims to create consistent two-way communication to build sustainable relationships. Strengthening IR can improve valuations and help companies secure access to capital on better terms.

back to top ↑

K

Key Performance Indicators (KPIs)

Metrics that measure a company’s progress against objectives and peers. Companies typically develop KPIs relevant to their strategy, operations and shareholder returns.

back to top ↑

L

Lead Independent (Presiding) Director

The lead independent director presides over meetings and serves as the liaison between the CEO, Chairman and a board’s independent directors. The lead independent director also serves a prominent role in communication with shareholders, succession planning, approving meeting agendas, information quality, authorizing consultants, and crisis management.

Legal Entity

Broadly, a company, or organization with legal rights and responsibilities such as the ability to create contracts and be sued.

Limited Company (LC)

A form of incorporation in which the company is a separate legal entity from its shareholders. Each shareholder’s liability is limited equivalent to their stake in the company or guarantees provided.

Limited Liability Company (LLC)

A private business structure in the United States that protects owners from personal liability and offers tax benefits similar to a partnership or sole proprietorship.

Long-Term Incentives

Compensation in the form of cash, shares, performance units, options, or restricted stock that rewards executives, typically over a three to five year period. These incentives usually require meeting difficult demands to incentivise high-level performance.

back to top ↑

M

Majority Voting

When nominees in uncontested elections must receive more “for” votes than “against” votes to be elected to a company’s board of directors. This approach makes sitting board members beholden to those they represent. The definition of majority voting varies across regions and companies.

Malfeasance

Malfeasance is an intentional act of sabotage, fraud, or other improper action by one party that causes damage to another.

Management Board

Part of the dual board (two-tier) corporate structure that is most common in Europe. The management board is responsible for making strategic, operational, and financial decisions within its delegated authority. The management board is overseen by the supervisory board.

Management Entrenchment

The extent to which managers are protected from market forces and control mechanisms. Regardless of poor performance, entrenched management can survive board monitoring, pressure from shareholders, and hostile takeovers.

Management Reporting

A type of business intelligence (BI) containing non-audited financial information and managers use to monitor performance versus target, make decisions, and inform other executives. These internal reports do not follow GAAP or IFRS.

Material Information

Non-trivial information that a reasonable investor would consider when making an investment.

Memorandum of Association

One of the two governing documents that form a company’s constitution. The memorandum defines the company name, type of company, name of all shareholders, registered physical address, and the date of corporation. See also Articles of Association.

Moral Compass

The internalized ability to distinguish right from wrong, guiding an individual towards ethical actions and decision-making.

back to top ↑

N

Negligence

A type of unintentional tort in which someone’s actions inadvertently cause harm to another party in a situation that a reasonable person would have foreseen and prevented.

Nominating and Governance Committee

The committee responsible for evaluating a company’s governance structures and the effectiveness of its board of directors. The committee plays a leading role in shaping corporate governance and can identify board nominees with the qualities needed to deliver on their vision of governance.

Non-Binding Vote

A vote taken by the board of directors that has no binding authority but is used to show support or disapproval e.g. management has the right to reject or adopt.

Non-Shareholder Interests

The consideration of the impact of board decisions on stakeholders other than shareholders, including employees, customers, and society.

back to top ↑

O

Observer (Advisory) Directors

Individuals who have not been elected to the board and cannot formally vote on board matters but are allowed to participate in board meetings as advisors.

Operational Risk

Describes a company’s exposure to unforeseen losses and disruptions during day-to-day business. Operational risk emerges from internal factors such as failures of systems, technology or persons.

Operational Succession Plan

The identification and development of in-house candidates with the potential to take over for a departing company leader. The point of a succession plan is to make the transition of leadership as smooth as possible.

back to top ↑

P

Pay for Performance

Strategies that align executive compensation with company performance.

Peer Group

Individuals or organizations that share certain characteristics. For individuals, this might include a similar age or educational background. Companies in the same peer group share characteristics such as size, industry, level of success, etc.

Performance Units (Shares)

Contingent pay in the form of cash or stock awarded after a performance period if specific financial and non-financial goals are achieved.

Performance-Vested Options

Options that trigger only when specific achievement targets are hit, for example a product launch, earnings-per-share, or return on investment.

Preferred Stock (Shares)

Stock that takes priority over common stock in the event of a bankruptcy or merger and gives holders a greater claim to dividends.

Principles-Based Accounting Standards

An accounting system that details accounting concepts and outlines preferred outcomes, but allows companies to use discretion when applying the principles. Internationally, principles-based accounting standards such as the International Financial Reporting Standards (IFRS) are more popular than rules-based accounting standards.

Principles for Responsible Investment (UNPRI)

Supported by the United Nations, UNPRI (or simply PRI) is an organization that supports and promotes environmental, social, and governance (ESG) investing. PRI establishes six principles that investors should aspire to.

Professional Director

A person who serves on corporate boards full-time and holds no other occupation.

Protected Disclosure

Information made known by an applicant, employee, or former employee of a company in which the disclosing person reasonably believes the information reveals dangerous, criminal, or otherwise non-compliant activity. By law, the employer can’t terminate or mistreat this individual simply for reporting this information.

Proxy Access

The right of long-term investors to directly access the company’s proxy materials, including the ability to nominate board candidates for the company’s annual shareholder meeting.

Proxy Contest (Proxy Fight)

When a shareholder or group of shareholders urges other investors to cast votes in their direction to achieve a preferred outcome, for example to elect a director.

back to top ↑

R

Recourse

An action taken by an individual, shareholder or company to attempt to remedy a legal difficulty.

Register of Directors’ Interests

A list of relevant information about the considerations (interests) of a company’s directors that might conflict with the interests of the company.

Regulatory Reporting

Mandatory reporting by companies to competent supervisory bodies to ensure compliance with legal and regulatory obligations.

Reputation

The general opinions held about an individual, company, or practice. Companies with a good standing (reputation) can typically utilize this to attract customers, employees and investors.

Reputational Risk (Reputational Damage)

A threat to a company’s good name or other intangible asset, arising through its own actions or through the actions of associated parties.

Resilience

An organization’s ability to withstand, adapt, and recover from internal or external disruptions or shocks. Resilience corresponds with sustainability and strong corporate governance.

Restricted Stock

Compensation in the form of non-transferable shares that can only be sold when specified conditions are met. This usually includes a multi-year vesting schedule to prevent early selling.

Risk

The inherent uncertainty and variability surrounding outcomes and the measurable likelihood of loss or underperformance. Risk ranges from common, calculated losses to extremely rare events. Risk cannot be completely removed and risk management is part of any sound governance strategy.

Risk Culture

An organization’s shared norms, practices, and beliefs about risk and the degree to which risk is openly discussed, identified, and managed.

Risk Management

How a company identifies, evaluates, and responds to risk. This includes creating policies and taking action to mitigate losses while maximizing value.

Risk Tolerance

The extent to which a company is comfortable with a higher degree of risk when pursuing a goal, in return for a higher reward.

Rules-Based Accounting Standards

A standardized, well-defined system of accounting that defines how companies should record and report financial statements. GAAP is an example of a rules-based system. A rules-based system is less flexible than a principles-based system.

back to top ↑

S

Sarbanes-Oxley Act of 2002 (SOX)

A U.S. law enacted in 2002 in response to a series of high-profile scandals such as the Enron accounting fraud. The law expanded existing regulatory requirements for publicly-traded accounting firms, companies, and their boards of directors. SOX also brought new regulations to private companies with strict penalties:

- Fraud violations are not dischargeable in bankruptcy.

- Falsifying or destroying documents can result in up to 20 years in prison.

- Hefty penalties for retaliation or otherwise interfering in a federal investigation.

Self Interest

The instinct to act for personal benefit. Not inherently bad if corporate governance aligns interests and reduces the opportunity for executives to act in a manner that will benefit themselves while hurting other stakeholders.

Severance Agreement

The provision in a contract that details the terms of an employee’s termination or resignation. May protect a company from legal claims or provide a company executive large compensation (a golden parachute) should they be dismissed as the result of a merger or takeover.

Shareholder

A shareholder (stockholder) is a private individual, company, fund or financial institution that owns shares in a company.

Shareholders essentially own the company and seek dividends and share price appreciation in return for their invested capital.

Shareholders can be passive or active, such as being elected on to the board of directors, seeking monthly updates, etc.

There are two types of shareholder. Common shareholders have the right to vote on matters concerning the company at annual (AGM) and extraordinary general meetings (EGM). They rely on corporate governance structures to ensure the company operates correctly but have the right to file law-suits in the event of wrongdoing. Preferred shareholders are rarer and typically have no voting rights, but are entitled to a fixed dividend which is paid before common shareholders.

In the event of liquidation shareholders are not responsible for liabilities but receive payment from liquidated assets only after other creditors.

Shareholder Agreement

A legal agreement between shareholders that outlines how the company should be run and describes the shareholders’ rights and obligations. A shareholder agreement often supplements the company’s constitutional documents and is typically a more private document.

Shareholder-Centric Perspective

The view that companies should prioritize shareholder value over other considerations. Other obligations, including ethical concerns, are only valuable to the extent that they increase value for shareholders.

Shareholder Democracy

A concept and movement that advocates for increased shareholder influence over corporate governance and increased access to relevant information. Proponents believe that shareholder democracy makes boards more accountable to shareholders.

Shareholder Relations (Investor Relations, IR)

The management of communication between a company and its shareholders. IR aims to create consistent two-way communication to build sustainable relationships. Strengthening IR can improve valuations and help companies secure access to capital on better terms. See also Investor Relations.

Staggered Board (Classified Board)

A board of directors structured so that only a portion (typically one-third) of the directors stand for re-election each term e.g. the entire board cannot be replaced in a single year.

Stakeholders

A party with a vested interest in a company who can affect or be affected by the organization. Key stakeholders include shareholders, employees, suppliers, customers, regulators and society.

Stakeholder-Centric Perspective

The viewpoint that organizations have an obligation to maximize value for a wide range of stakeholders and prioritize their wellbeing during corporate decision making.

Share (Stock) Options

Financial instruments in the form of contracts that give the holder the right to exercise, buy (call option) or sell (put option) the underlying asset at a fixed price before a specified date.

Succession Planning (CEO Succession Planning)

The strategy that a board of directors uses to ensure a smooth transition of leadership when the CEO leaves a company.

Supervisory Board

Part of the dual board (two-tier) corporate structure that is most common in Europe. The supervisory board oversees the management board.

back to top ↑

T

Tag-Along Rights

Please visit our Private Markets Glossary

Terms of Reference (TOR)

Terms of reference define the structure, purpose, and calendar of a project, board, committee, or other group with a common goal.

Transparency

The degree to which business and financial information is made readily available and is accurate. Transparency is important for investors to understand company performance and compliance and thus supports good governance.

Trust

A legal relationship in which one party (trustor) entrusts another party (trustee) the right to hold the title to an asset for the benefit of the beneficiary. Trusts are governed by the deeds of trust.

back to top ↑

Last updated: 11 th October 2021